End of Year Tax Checklist

Posted by Rebecca Harbrow on Wednesday 21st February 2024

As we approach the end of the tax year, it's a good time to start thinking about how to make the most of the tax reliefs and allowances you’re entitled to, before they are lost. We’ve put together a checklist to ensure you’re aware of all the ways to make sure you don’t miss out.

As we approach the end of the tax year, it's a good time to start thinking about how to make the most of the tax reliefs and allowances you’re entitled to, before they are lost. We’ve put together a checklist to ensure you’re aware of all the ways to make sure you don’t miss out.

Open or top up your ISA

You can hold up to £20,000 in your ISA in the 2023/2024 tax year and split the contribution, between either a Cash ISA or Stocks and Shares ISA.

Use your pension allowance

Usually if you’re under 75 can contribute to a pension and receive...

The essentials you need to know about credit checks before borrowing money

Posted by Rebecca Harbrow on Wednesday 7th February 2024

The information a lender finds during a credit check is important – it could affect whether you’re able to borrow money, including through a mortgage, and the interest rate you’re offered. Yet, they can also seem perplexing.

Indeed, a Royal London survey found that a third of Brits had never looked at their credit report.

The good news is that we can help you cut through the jargon, so you feel more confident next time you apply for a loan.

Lenders usually carry out a credit check to assess how much risk you pose

Lenders carry out a cr...

Additional Health Services Included in your Protection Insurance

Posted by Rebecca Harbrow on Wednesday 31st January 2024

Have a healthy new year with the additional health services included in your protection insurance

As a new year begins you may want a fresh start for you and your families’ health. Did you know that many insurance policies offer access to a range of health and wellbeing services that can help? You also don’t need to make a claim to use them as your protection policies aren’t just there for when things go wrong.

As a new year begins you may want a fresh start for you and your families’ health. Did you know that many insurance policies offer access to a range of health and wellbeing services that can help? You also don’t need to make a claim to use them as your protection policies aren’t just there for when things go wrong.

Often called added value benefits, these services can help you and your family start or maintain good health and make your lives e...

Mortgages

Posted by Rebecca Harbrow on Friday 26th January 2024

A quick guide to getting a mortgage and buying your new home

Most of us will borrow money to buy a property at some point in our lives. Whether you’re buying your first home, buying to let or remortgaging, it’s a big commitment.

Most of us will borrow money to buy a property at some point in our lives. Whether you’re buying your first home, buying to let or remortgaging, it’s a big commitment.

Here are some key facts to help you feel more confident about your financial decisions.

The different types of mortgages

The types of mortgages vary, depending on how long the term lasts, how much you pay every month and the interest rate.

- Fixed rate

The most common length of fixed-rate mortgages are two - ...

How Financial Advice Adds More Value to your Life than you may realise

Posted by Rebecca Harbrow on Wednesday 24th January 2024

The cost of living crisis is causing many to re-evaluate the benefits of financial advice.

Traditionally, the value of financial advice has been measured by monetary results of investment performance and returns. Today, the cost of living crisis is causing many to re-evaluate the benefits of financial advice.

These days, financial planning is about more than simply looking after your money and protecting your wealth. As well as helping you see results in pounds and pence growth, we can also help ensure you are prepared to meet the cha...

Make The Most of Your Income By Taking Advantage of The Tax Allowances Available to You

Posted by Rebecca Harbrow on Thursday 18th January 2024

Did you know that tax breaks could help boost your salary, savings and investments?

It’s easy to miss out on their full benefits as tax can be complex. But with help from your adviser, you can explore the following tax allowances in more detail.

It’s easy to miss out on their full benefits as tax can be complex. But with help from your adviser, you can explore the following tax allowances in more detail.

For married couples or those in a civil partnership

You might be able to take advantage of the marriage tax allowance. It allows one half of a couple who earns less than the income tax threshold (which is £12,570) to transfer up to £1,260 to their higher-earning spouse – who must be a basic rate t...

VouchedFor Reviews - Latest

Posted by Rebecca Harbrow on Wednesday 10th January 2024

Our latest reviews are in and we're proud to show you our latest reviews from clients regarding their experience with working with Rebecca.

Our latest reviews are in and we're proud to show you our latest reviews from clients regarding their experience with working with Rebecca.

Reviews allow clients and prospective clients a glimpse into how we work at Blue Heron and how we are perceived.

You can view our latest reviews here

Earn: How to Make The Most of Your Income Today and Save Enough for Tomorrow

Posted by Rebecca Harbrow on Friday 5th January 2024

How to make the most of your income today and save enough for tomorrow

Create your budget in four steps

Create your budget in four steps

Setting up a budget won’t take long, and if you stick to it then you could boost your savings at the same time. Your budget should chart your income, outgoings and financial goals and give you a spending plan to follow.

A budget can put you in control of your money because you’ll know exactly where each pound is being spent (or saved). And any savings you make in a month or money you bring in in addition to your regular income can be in...

Save & Invest - Set your Savings Goals

Posted by Rebecca Harbrow on Thursday 14th December 2023

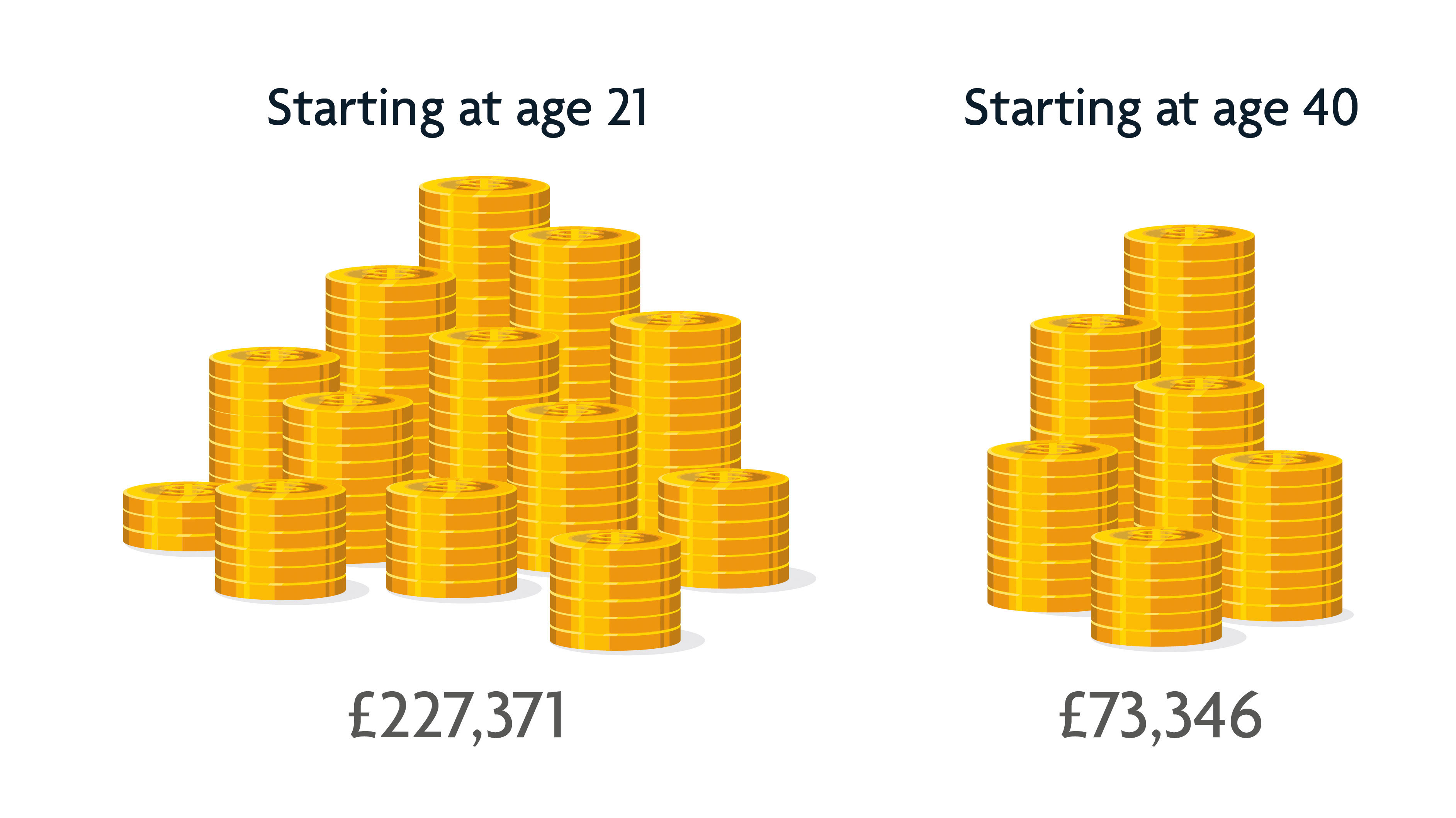

Investing can lead to greater growth potential. The longer your money stays invested, the more it benefits from compound growth—earning on your earnings—which significantly boosts your final investment value.

The value of investments and any income from them can fall as well as rise and you may not get back the original amount invested.

Approved by The Openwork Partnership on 30/11/2023

Mike & Michelle's story: How income protection helped after a mountain bike crash

Posted by Rebecca Harbrow on Friday 1st December 2023

Little things can make a massive difference. Like the mountain bike accident that turned Mike’s life upside down.

Thanks to his protection insurance policy, Mike and his family are financially secure.

Video approved by The Openwork Partnership on 20/07/2023

Expiry date: 18/07/2024