Spring Clean Your Finances

Posted by Rebecca Harbrow on Friday 29th April 2022

There’s plenty of advice and ‘life hacks’ on how to make spring-cleaning less of a chore. A quick Google search will throw up hundreds of random tips – like using cola to clean the toilet, lemon to clean the taps and vinegar to clean just about anything!

When you’ve finished scrubbing your worktops with baking soda and polishing your windows with newspapers, why not try spring-cleaning your finances? Here are some handy hints to get you started:

Throw away unnecessary spending habits

Look at your bank statements for the last couple of m...

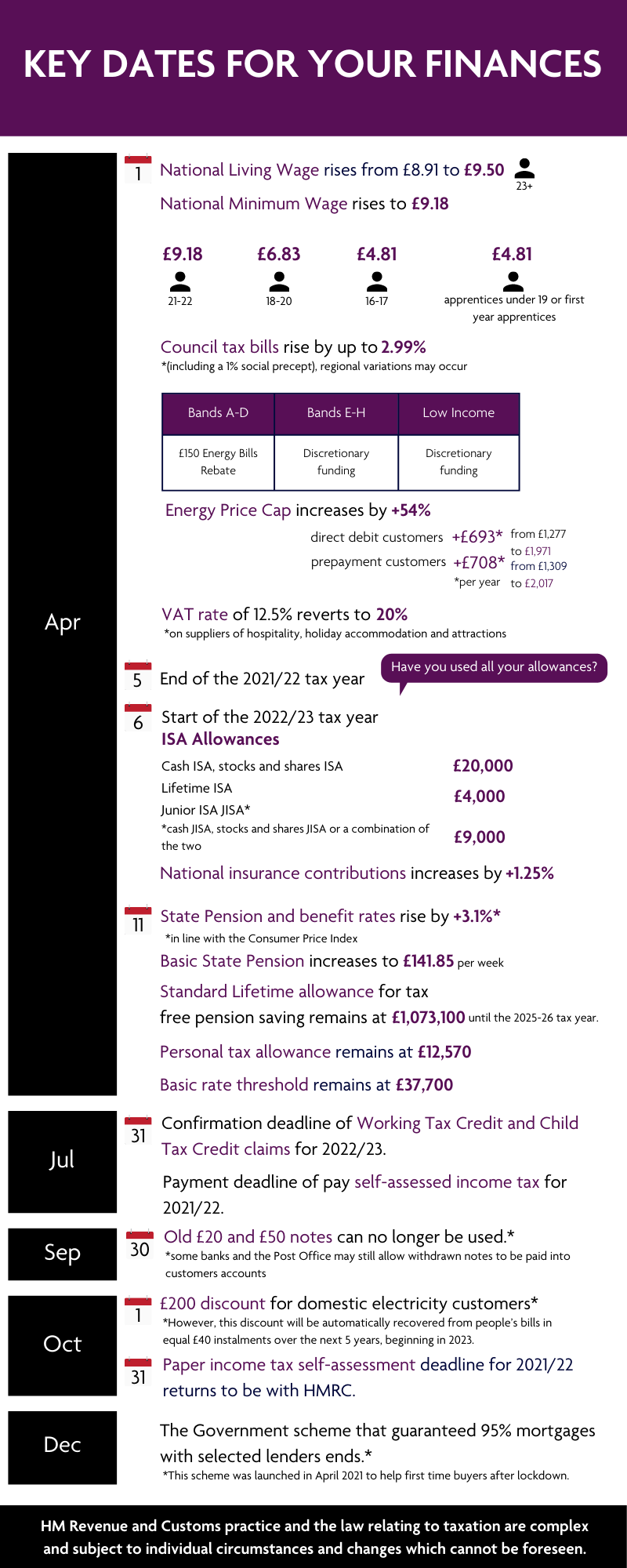

Key Dates for Your Finances

Posted by Rebecca Harbrow on Wednesday 27th April 2022

Now’s a good time to make sure you're fully prepared for the financial year ahead. To make it easy we’ve summarised the key dates and facts and figures below.

Now’s a good time to make sure you're fully prepared for the financial year ahead. To make it easy we’ve summarised the key dates and facts and figures below.

1 April

National Living Wage (for age 23+) rises from £8.91 to £9.50

National Minimum Wage rises to £9.18 (for 21-22-year olds), £6.83 (for 18-20-year olds), £4.81 (for 16-17-year olds) and £4.81 (for apprentices under 19 or in the first year of their apprenticeship).

Council tax bills rise by up to 2.99% (including a 1% social care precept) although there may be some regional vari...

What is Capital Gains Tax?

Posted by Rebecca Harbrow on Friday 22nd April 2022

If you’re selling certain assets of high value or a second property, you’ll probably have to pay capital gains tax on your profits. Here’s how it works.

Capital gains tax (CGT) is a tax on the profits earned from selling an asset or a property belonging to you (excluding your main residence). You only pay CGT on your overall gains above your tax-free allowance – known as the ‘annual exempt amount’. In the 2021/22 tax year this amount is £12,300, so you can make this much in profit before you pay any tax. Married couples or those in civil ...

What does a financial adviser do?

Posted by Rebecca Harbrow on Wednesday 20th April 2022

What does a financial adviser do?

A financial adviser can help with your investment goals, but they can also offer many more ways to understand and make the most of your money.

You might think that people who use financial advisers are just investing in the stock market or need someone to manage their portfolios. But a financial adviser can do a whole lot more.

Different types of financial advice

For an adviser, it’s their aim to help you achieve your financial goals, but that doesn’t just cover building wealth through investment – their...

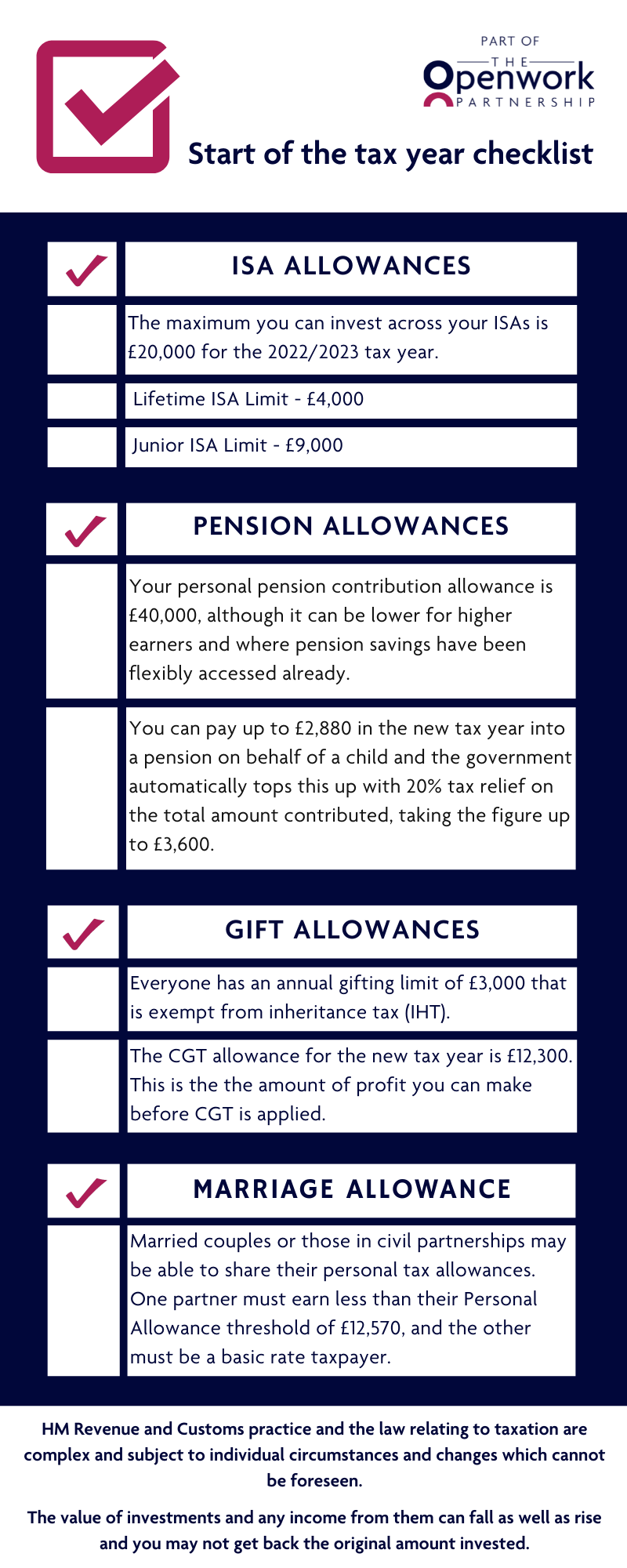

Start of the tax year checklist

Posted by Rebecca Harbrow on Friday 8th April 2022

The new tax year on 6 April 2022 is a great time to review your finances.

The new tax year on 6 April 2022 is a great time to review your finances.

The new tax year means annual allowances are reset and ready to be reused – to help you make the most of your money. This year more than ever, with interest rates and inflation on the rise, it’s a great time to review your pensions and investments with your adviser.

Note: The following figures apply to the 2022/2023 tax year, which starts on 6 April 2022 and ends on 5 April 2023.

ISAs

The maximum you can invest across your ISAs is £20,000 (if it’s a cash ISA, stocks ...

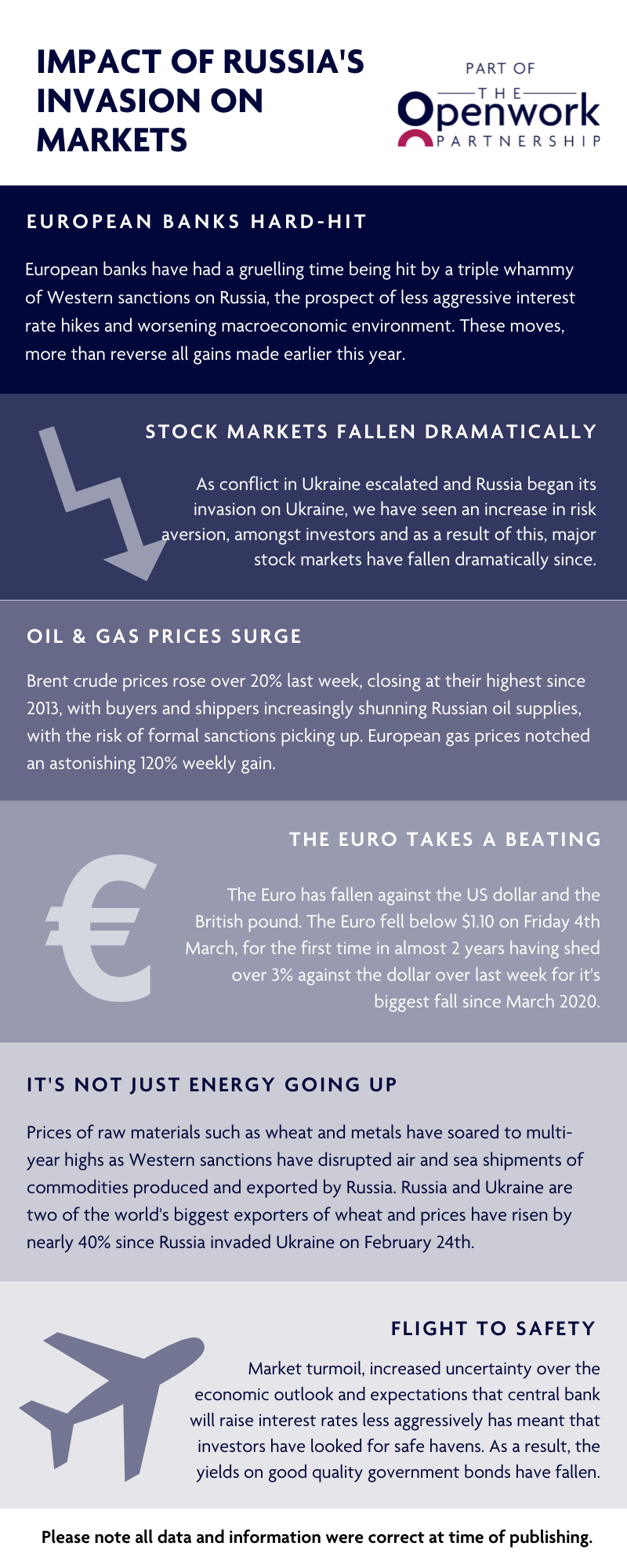

Impact of Russian Invasion on Markets

Posted by Rebecca Harbrow on Wednesday 6th April 2022

Spring Statement Report and Tax Tables

Posted by Rebecca Harbrow on Monday 28th March 2022

In the Spring Statement the Chancellor, Rishi Sunak, set out a limited package of support to help ease the cost-of-living crisis.

As promised, our Spring Statement Report 2022 is now available, containing more comprehensive detail on all of these changes and announcements.

Alongside this, our Tax Tables leaflet left provides you with a quick reference guide.

End of Tax Year Checklist

Posted by Rebecca Harbrow on Friday 25th March 2022

Make more of your money with your adviser, before the end of the 2021/2022 tax year on 5 April 2022.

As the end of the tax year approaches, there’s still time to take advantage of your annual tax-free allowances if you’ve not already done so. This is one of the best ways to make your money work harder and grow, especially with interest rates on the rise. We can guide you through the best ways to use your allowances – depending on your needs.

As the end of the tax year approaches, there’s still time to take advantage of your annual tax-free allowances if you’ve not already done so. This is one of the best ways to make your money work harder and grow, especially with interest rates on the rise. We can guide you through the best ways to use your allowances – depending on your needs.

ISAs

The maximum you can invest across your ISAs (if it’s a cash ISA, stocks and shares ISA or innov...

Spring Budget Highlights - March 2022

Posted by Rebecca Harbrow on Thursday 24th March 2022

Chancellor Rishi Sunak has announced a limited package of support to help ease the cost-of-living crisis but resisted calls to scrap the planned National Insurance hike.

Living costs have soared since Covid-19 restrictions were eased and the Russian invasion of Ukraine has pushed gas and fuel prices up further. The annual rate of inflation jumped to a 30-year high of 6.2% in February, up from 5.5% in January. Inflation had been predicted to begin levelling off this year, but with the impact of climbing energy and food prices it now looks se...

Investment Update - Shaken but not stirred

Posted by Rebecca Harbrow on Wednesday 16th March 2022

Persistently high inflation is putting pressure on central banks to raise interest rates, which unsettled markets during the first few weeks of the year

Persistently high inflation is putting pressure on central banks to raise interest rates, which unsettled markets during the first few weeks of the year

At the start of 2020, the World Bank issued a warning that the global economy faces a variety of challenges, including new Covid variants, high inflation and an uncertain geopolitical landscape. Its economists lowered their growth forecasts and suggested that some richer countries might not reach pre-pandemic levels of output until 2023, with poorer ones taking longer.

Central bank moneta...